With the upcoming IPO of TSB banking stocks are on the mind of many private investors. While many private investors have no doubt been mulling over the prospectus I have also been thinking about the banking sector from an investment point of view.

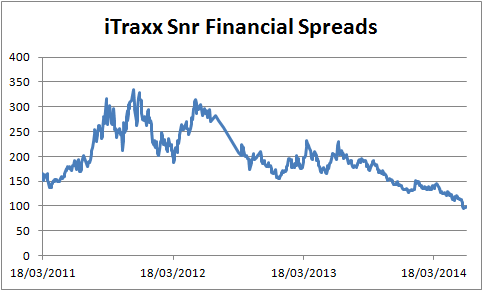

The chart below shows the credit spreads of the iTraxx Snr Financials Index – an index of European financials such as HSBC, Lloyds TSB, RBS, Allianz, BNP Paribas, Credit Suisse etc. The charts clearly shows that credit spreads have been in decline which in other words the market views these institutions as less risk than over the last two years. Great news for investors right? Well I’m afraid that I don’t buy it.

I’m partial to a bit of active stock selection, however I’m fully aware of my deficiencies as an equity analyst. That said, one of the main advantages I can use in my stock selection is the personal experiences I have of companies. Whether it’s as a customer, an employee or a friend or relative of an employee there are almost unlimited ways for us all to get good insights of potential investments through our web of contacts and day to day experiences.

Working in the banking industry (13 years and counting) for example gives me a great insight into the challenges and opportunities that the sector as a whole face. While obviously I can’t trade using inside information, I can use my knowledge and experiences in my company to extrapolate out to others in the industry. So what’s my take on banking?

Regulation

It”s no secret that the de-regulation of the global banking industry contributed to the global financial crisis in 2008. The proliferation of securitised products (MBSs, CLOs, CDOs, CDs, ABS etc etc) spread financial risk around the globe, usually to people and institutions that didn’t fully understand it. This was true right from the low income families in the US taking on interest rate risk/mortgage debt they couldn’t afford to the likes of AIG taking on counterparty risk it thought would never default.

All throughout the financial system excess risk was being taken. As banks had access to almost unlimited capital & cheap funding they were more than happy to give the people/pension funds/hedge funds/anyone what they wanted.

Post crisis, the powers that be have decided that the way to avoid a repeat financial crisis is to restrict the capital of banks through new regulation. As a result a whole deluge of regulations are being rolled out from regulators around the world.

Much of the purpose of this new regulation is to make the banks hold more capital, forcing them to take less risks and ultimately be less susceptible to financial downturns. However as with all regulations, there are always a huge amount of unintended consequences.

Unintended Consequences

It is already apparent that many of the big banks are selling off parts of their businesses that are less profitable or more capital intensive. Barclay’s has become the latest bank to pull out of commodities. In virtually all business areas that banks are involved in consolidation s happening.

Interestingly many such areas of business (that used to be performed by banks) are now being performed by entities such as hedge funds that are far less regulated than banks. New products like CRTs are being pedalled by Hedge Funds and being used by banks to offload risks and move them elsewhere in the financial system.

For banks this ‘outsourcing’ of risk might be a good thing in the short term, and help them achieve capital goals, but it may not be reducing the risk of a future financial crisis that will hurt them like in 2008. The same risks are being taken only this time they’re not all sat on banks balance sheets.

Capital versus PnL

There are quirks in virtually all of these new regulations that mean banks are often not incentivised to do the right thing. I’ve seen many examples over the last few years where a perfectly hedged trade generates a large capital requirement because the trade and the hedge are capitalized under different regulatory calculations/models.

If the trader left the position un-hedged the net capital charge would be reduced. In other words the current regulation sometimes incentivises the trader not to hedge all of his risk. If the trade is capital intensive and good for a client relationship then it may well go un-hedged.

In many cases, such as above, trading decisions are being made by looking at the pay off between the risk to PnL against the capital demands of a trade. While the idea that banks turn down risky, capital intensive trades seems like a good idea, sometimes they’re taking on risky trades due to their lower capital demand.

Conflicting Rules

Working in a global organisation means that you are also answerable to numerous regulators. I’ve encountered many situations where UK, European and US regulators read a situation differently. They might interprate each others regulations differently or allow different exclusions, exemptions and expectations.

There is also a certain amount of one-upmanship going on between financial regulators around the world. Quite often the large delays in the roll out of some of these regulations are due to the fact that different regulators can’t agree and are busy arguing about the merits of their ideas rather than seeking consensus.

Costs of Change

The sheer volume of new regulations being faced by banks is phenomenal. Whether it is Dodd Frank, Basel 3, CRD4 or Volcker there is a constant stream of new rules and requirements that banks must comply with. As time goes on the regulatory frameworks that banks must comply too are becoming ever more complex.

In order to ensure regulatory compliance, banks are spending vast sums of money on building new IT systems, hiring consultants and beefing up their control functions. All of these costs are further straining the capital of banks and are likely to continue to do so for many years to come.

Banks as Utility Companies

We’re now nearly 7 years after the financial crisis of 2007/8 began to unfold and banker bashing still very much remains a popular activity. The world suddenly became aware of the importance of the banking sector during the crisis and the dire consequences on offer should it fail.

Going forward I can see us moving forward to a situation where, like utility companies, the profits that a bank can make are determined by the regulators. I think this is probably a good thing from a holistic view but a bad thing from a shareholders point of view.

As if the case with energy companies the problem is that banks tend to be inter connected and together a small few control the flow of most of the worlds money around the globe. When the flow stops (as it did in 2008/2009) there are dire consequences for all. Therefore it makes sense to force the banks to stop tapping the pipes and draining money out of the system and instead regulate them to simply maintain flow/liquidity and limit the profits they can take.

Summary

All of the above points lead me to believe that banks aren’t a great investment right now and won’t be in the short-mid term. Capital requirements are only going to increase over the next few years and along with that comes:

- reduced opportunities to generate profit

- substantially increased costs

- an outflow of ‘talent’ to more unregulated/profitable sectors

While there will be some winners from the consolidation happening in certain businesses, the challenges facing banks from the regulatory landscape is enough to keep me from owning them. The whole industry is being reshaped by the regulatory burdens being placed on it. Even from my vantage point on the front line I can’t see what it will look like in 10 years time.

Disclaimer: I’m a member of an employee share ownership scheme at the bank I work at (I take part purely for the tax breaks). I’m currently selling any shares I get as soon as the tax benefits are realised.

What are you thoughts? Are you going to slot some TSB in your portfolio?

Interesting post. I do see some of these factors counter-acting each other. For instance, I think big banks will post lower ROE in the future, but I think they will also be perceived as safer (and likely will be, at least for a decade or so) and they’ll likely return a lot of capital to shareholders. So whereas they might have aspired to ROE’s of 15-20% and shareholders bid up the price to 2-3x book value, in future I think they’ll do maybe 10-12% ROE but still get a rating of twice book for their dividends and security. (Obviously they’ll vacillate all over the place! But I mean ballpark targets).

I bought the TSB IPO. Can’t beat a forced sale for value, IMHO, and in this case there was even a 5% extra free shares in a year kicker for the first £2,000. 🙂 So I invested exactly £2K. 🙂

Monevator,

TSB – that 5% kicker very nearly tempted me but I managed to resist.

While I agree that banks will likely be safer than they were, I’m not convinced there’s going to be a massive return of capital to shareholders. The regulators are going to be cranking up the minimum capital requirements for a while yet and while that’s ongoing, banks need all the capital they can get. In parallel they are being forced to reduce risky assets (which incur high capital charges) which is traditionally where the money was. Trading volumes are still very low so any capital light ‘flow’ businesses simply aren’t making much $. Add in the long queue of litigations still to be settled over mis-selling, price fixing and god-knows-what and I’m pretty bearish on the industry.

Might be too late for bearish.

Look at the chart for Dbx tracker ETF XS7R (europe banks inc UK).

I was fortunate enough to buy this near the bottom. That was when there was a lot of bearishness.

Bad news is probably priced in. The whole world knows that the banks will not be allowed to collapse and that there will be QE to infinity and beyond to prevent it.

I’m not saying go overweight banks but some of them look pretty decent value to me. Or just buy the ETF.