With stock markets at or near all time “highs” it is worth reminding yourself about the importance of price and value of proposed investments. I think it was a certain Mr Buffet that once said…

“Price is what you pay, value is what you get“

Whether you believe the markets are currently due a fall or not, it is always crucial try and buy your investments at the right price. I don’t want to delve in to the dark art of security valuation in this post but instead take a look at how buying your investments at the right price can turbo charge your future returns.

Lets assume you’re looking to buy £5,000 worth of shares in UTMT PLC.

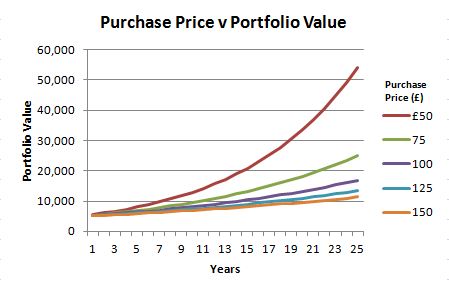

Due to market volatility, and depending on when you bought the shares you might have paid £50, £75, £100, £125 or £150 per share at some point over the last 2-3 years. Lets also assume UTMT PLC pays a steady dividend of £5 per year which you duly re-invest each year. The price you paid for your UTMT shares has a dramatic impact on future value of your UTMT portfolio:

Of course you need to take the above graph with huge pinches of salt because I’m making some pretty wild assumptions:

- Annual dividend payments remain constant at £5 per share over the 25 year period

- I only focus on income, completely ignoring any capital appreciation/depreciation that would occur in real life

- Inflation is zero (which turns out to be correct for the time being at least!)

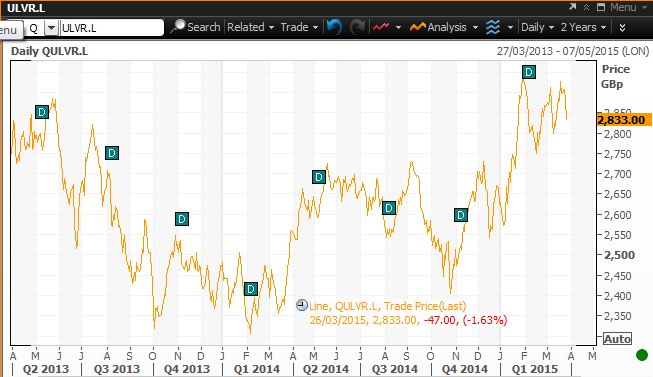

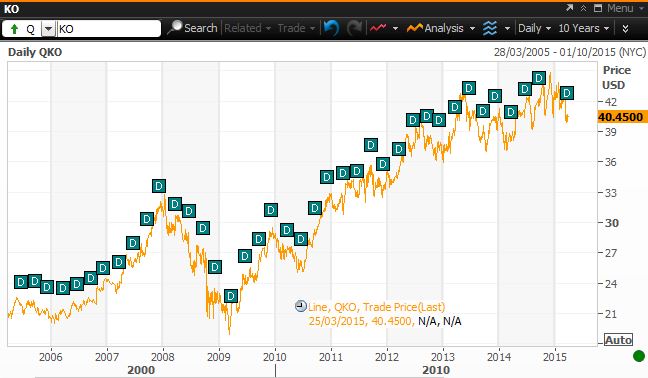

That’s all very well but do defensive shares really swing around in price as much as UTMT PLC does? Well just look at how a couple of supposedly steady Eddie shares like Coca Cola and Unilever bounce around in ‘value’ over the space of a couple of years:

Looking at the KO chart above you can see that ‘high’ price of roughly $44.5 is roughly 20% higher than the ‘low’ of $37. That can make a big difference to long term investment returns. So we can see it makes sense not to overpay for companies in order to maximise your future returns.

But hang on a minute, 24 months really isn’t long (or shouldn’t be) in investing terms. Look what happens when you look at the 10 year price chart for KO…

That $44.5 is roughly 135% higher than the low of $19 back in 2009. Investing at times of low prices like these is a sure fire way to supercharge your future returns.

Of course the elephant in the room here is timing the market. Personally I’m of the belief that this is a pretty futile activity to try to participate in. Quite frankly I haven’t got a clue what the price is going to do 1 day, week, month, year from now so it makes perfect sense for me not to try to predict future prices.

Instead I focus purely on the current price and the value (or lack of) that it offers me. From there I can (try to) make an informed decision about if I invest or not.

As you can see by the KO and ULVR charts above the stock market is a schizophrenic. In order to try and benefit in the long run you must try to separate what you think a company is worth, from the price which is what the market thinks it is worth. If you’re an active investor then this is where you need to focus your attention.

This article isn’t telling you to go out and buy the shares with the highest current dividend yields. The current dividend yield of a share should tell you something about the probability for future dividends flows. Chasing yield is usually an activity that ends in tears.

If you are going to overpay for a share then you’re generally a lot better off overpaying for a high quality company rather than a lesser one. Instead the point is to try and buy great companies when the market is pricing them with artificially high dividend yields.

Hi UTMT,

“The current dividend yield of a share should tell you something about the probability for future dividends flows. Chasing yield is usually an activity that ends in tears.” – This is exactly what I did a few years back with HMV… and that definitely ended in tears.

I am very much in the camp of investing in trackers at the moment and I view individual stock selection as a bit mystic at the moment. But I am considering building part of my portfolio with dividend stocks in the future, once I have a sizeable amount in low maintenance trackers.

I am pretty happy with technical analysis on a company/stock but I would suffer from paralysis I think, and sit and wait for an even better yield on companies I thought looked good. As you say, picking them up with a ‘depressed’ price can have huge impacts on your portfolio in the future. How do you stop yourself from trying to ‘time’ your purchases?

Mr Z

UTMT Plc looks good, when is your IPO?

Is t

Mr Z,

Funny you should mention HMV. I had a friend that was trying to persuade me to invest in it for the high yield. I just couldn’t see past the fact that the CD business was getting killed by downloads and did my best to persuade that the business was dying. He ignored me and lost a fair chunk, he never told me how much.

The same principles apply to investing in trackers as well as individual companies. I try to avoid timing the market by buying/investing regularly and simply buying more when prices are ‘cheap’. If you’re running a pure index/etf/fund portfolio then you can do the same by deciding your asset/industry/region mix and rebalancing every 3/6/9/12 months. By diverting new capital to those holdings that are under represented (and by definition cheap) during rebalancing, you’ll naturally tend to avoid overpaying for them. The key is deciding your asset mix and them STICKING TO IT!

Sounds like you did the exact opposite to me, i.e. the clever thing on HMW!

I always forget that rebalancing will have that effect rather than just heading back towards your original risk appetite.

I suppose you could take a similar approach with individual stocks with regular investments, like is more common with a fund approach. As long as you are happy with the business, why not!

Mr Z

Hi UTMT, nice summary. I think one important point you make is focusing in on the current price. I get asked all the time if I look at technical factors, “momentum” and all that sort of stuff. My answer is always NO! I don’t want to base my investment decisions on whether or not the share price has gone up or down recently. That’s just tea leaf reading as far as I’m concerned.

If I’m buying a car I don’t care what the price was last week. I just care about how much value for money I’m getting relative to what else I can buy at the moment. It’s the same with companies and shares.

UK Value Investor,

I fully agree. I think us humans are hard wired to respond to emotions, historical patterns and such like. It is naturally very hard for us to detach the past and focus just on the present situation in front of us. It’s much easier to justify something because the tea leaves say so rather than because it is your judgement at stake, that way we can blame the tea leaves when it goes wrong.

Of course all of this presents a big challenge and indeed an opportunity to investors that can focus just on the current situation.

Thanks for focusing on this UTMT. There is a possible comparison with the housing market here. Although I think the housing market would be better labelled bipolar rather than schizophrenic due to a lack of hallucinations and delusions. The problem with housing is that it IS about timing, we do care about the price of a house yesterday. Don’t we?

There seems to be a bit of an obsession in investing with being unemotional or it’ll all end in tears. Yet the market is a paranoid schizophrenic! It is rather like taking painkillers regularly to mask any pain that might occur in the future. I like what Prof. Taffler said to WSJ:

“In a sense we’ve got an institutional structure which seeks to deny that ultimately we’re all working in an environment that is inherently unpredictable.”

And on his research on top investors and their supposed unemotional investing:

“You need to recognize that cognition and emotion go together; you can’t have one without the other. If you were coldly unemotional, which is of course not possible, then you wouldn’t actually be able to generate the conviction necessary to take the risk of investing.”

I have seen research done that the long term return of dividend growth stocks is very much impacted by the price at which you buy them. By getting them on the cheap, your start yield is high, so the compounding effect is faster.