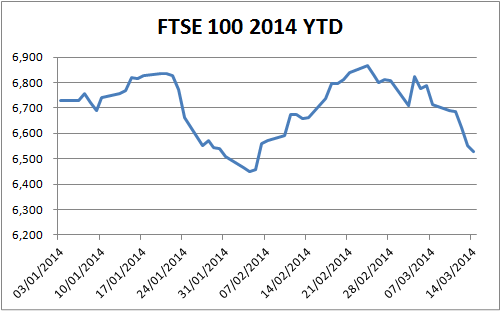

What a difference a year makes. This time last year the FTSE 100 had got the year of to a roaring start, soaring from just under the 6,000 mark to 6,529 on the 14th March. That was a whopping 11% gain in two and a half months.

This year started in a promising fashion too before the market sold off in the last week of January and the first half of February. Since then we rallied and sold off again. We look no nearer passing the magical 7,000 mark than we did 1 year ago and year to date the index has returned -3.3%.

The market feels to me like it has just woken up from a heavy sleep. With economic growth labouring somewhat and the economic data not really inspiring much confidence, the chances of another sustained push upwards seem slim to me, at least in the short term.

I’m a longtermist so I shouldn’t really give two hoots about the short term I hear you say. Well usually I’d agree but at this time of year there are ISAs to be filled and bonus’s to be invested so from a personal perspective this directional limbo we seem to be in at the moment is a bit of a pain. I like to be fully invested.

There seems to be two grey clouds hovering over the financial markets on a global scale.

1. The Crimea/Ukraine/Russia situation is weighing heavily on European markets. Should the situation escalate there could be various effects that will cause economic pain in Western Europe. According to the beeb, Russia currently provides 1/4 of Europe’s natural gas, half of which gets piped through the Ukraine.

There seems to be a giant game of political bluff going on over the Crimean peninsula. The West is vaguely threatening economic sanctions on Russia that, if followed through, could seriously damage the Russian economy. However if these sanctions were imposed and Russia turned the gas tap off into Europe the economic pain would be felt on both sides of Kiev.

In addition, it is not clear if the West is really willing to risk losing all of that lovely Russian capital that’s invested in it’s capital markets. The West’s position seems to be caught heavily between outrage of the blatant land grab by Russia and the economic risks to their fragile economies of imposing serious sanctions to punish Russia. Putin knows this and is fully exploiting this uncertainty.

2. China. With growth continuing to slow and the first corporate defaults in China slowly evolving into a trickle there are some serious fears that the China bubble may one day soon start to burst.

As suggested in the very interesting BBC documentary there is a serious risk that the shadow funding sector in China could unravel at some point. If this was to turn out to be correct we would see an almighty global recession, the likes of which we probably haven’t seen before.1

Liquidity

Now that the great taper has begun (all be it incredibly slowly) I think we (and the markets) are now much more susceptible to type of bad news mentioned above. It feels like all of this bailout money and extra liquidity has given the markets a [poor] excuse to rally over the last 2-3 years.

Now that liquidity is reducing, the markets responses to bad news will surely only get more pronounced. It feels like we’re getting back to the way the markets were pre crisis. I also feel that correlation between different markets will also increase.

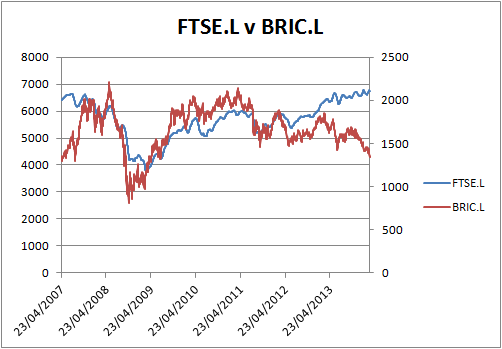

As I mentioned a few weeks ago the Emerging Markets will present some opportunities to make some money at some point soon. Just look at how the performance of the FTSE and the iShares BRIC ETF (BRIC.L) have diverged over the last year…

Does this simply mean we should all buy some BRIC, kick back and get ready to light the cigars? I don’t think it is that easy. I’m thinking about this divergence in performance not so much in a directional way but in a relative way. Basis.

I can’t see a likely scenario where the basis between these two indices stays this wide for much longer, certainly not in the mid/long term. The big question I still don’t know the answer to is how that basis will close. I can see 3 likely outcomes based on where we are today:

Scenario 1. Both indices rise, however the BRIC.L will do so faster (outcome = basis closes)

Scenario 2. Both indices fall, however the FTSE will do so faster (outcome = basis closes)

Scenario 3. The FTSE continues to rise and BRIC.L continues to fall (outcome = basis widens)

While in the short term scenario 3 may well continue I believe that it’s won’t be too long before either scenario 1 or 2 happens. So what to do? Well I see two ways to try and benefit from the closing of this basis if it happens:

1. Simply hedge/further diversify/rebalance my current portfolio by increasing my BRIC exposure by buying some BRIC.L or some such other BRIC fund.

2. Construct a new/distinct basis trade by going long BRIC.L and also buying a short FTSE ETF (like Deutsche Bank’s db X-Tracker FTSE 100 Short Daily ETF. Ticker = XUKS.L) specifically to benefit from any basis tightening.

Option 2 sounds much more exciting and potentially more profitable, particularly if Scenario 2 above turns out to be correct as generally I am long FTSE. However going short any ETF requires a deep understanding of how the returns are produced and will require much more vigilant risk management.

Given my long term approach and the complete lack of time in my personal life these days to manage such a position option 2 is ruled out for now. Instead I think I’ll continue to sit on my hands and buy some BRIC when the upturn begins. Whether this is post the Crimea crisis or post any Chinese Credit crisis remains to be seen!

Notes:

1. While this would hurt it could also present the biggest buying opportunity that will likely present itself in my lifetime.

Tempting, isn’t it? 🙂 I am not buying much at all that hasn’t been dinged by exposure to the emerging markets at the moment. (Most recent buys were Unilever and PZ Cussons!)

Surely from your 3-point analysis the obvious/simplest thing to do is physically sell some of your FTSE exposure (i.e. Not via shorting) and then buy more of the BRIC ETF or similar?

Given we both agree that (3) cannot last forever, it’s a win when either (1) or (2) happens, albeit a relative one in the second case.

I’m getting a bit nervous about China too, which is why despite my opening remarks I’m not wholesale swapping my portfolio for the EMs. 😉

I am committed to holding my FTSE exposure for the long term so would prefer not to sell and simply replace with EM, hence my tendency to complicate things! I also tend to run 80% of my portfolio as a defensive income portfolio (single name & etfs) and 20% in growth stocks, commodities, rates, fx and anything else I fancy dabbling in. I like to keep the income part well ringfenced from everything else!

China is definitely the elephant in the room from my point of view. That said I quite like the way the government appears to be pushing through reforms and allowing market forces prevail to some extent (in the form of the defaults). At least they seem to be aware of the risks/problems and trying to cool things down slowly. Unlike other EM giants like India, the Chinese government seem to get things done when they want to so hopefully they can manage to deflate the bubble slowly! All that said I really am no expert on China!