The thing I hate about investing is the waiting. I realised a few years ago that getting rich slowly was a much better bet than trying to make it happen quickly. With a well thought out strategy and a long term view it’s possible to stack the odds heavily in your favour. The hardest part of this approach however is to assume a long term view.

As time goes by my investment decisions are being made with a longer time horizon in mind. For example my buy to let investments are investments where I won’t realise the full benefits (the rental income without having to pay any mortgage interest) until between 10-20 years time.

Nordic Nouse

The Norwegian government presents an excellent argument for ‘longtermism’ with the way they invested large amounts from their oil wealth from the 1970’s onwards into their sovereign wealth fund, the ‘Government Pension Fund Global’.

The fund is designed to remain a long term asset of the Norwegian state – a maximum of 4% of the fund s value can be spent each year, a kind of self imposed draw down rate. It is currently the largest wealth fund in Europe and is expected to reach a valuation of $tn by the end of 2014.

What would the UK do now for a wealth fund like Norway? It could be argued that all the benefits from our North Sea oil were realised at the time and spent on fast cars and filo faxes in the 1980’s and 1990’s. With all of the UK’s oil profits spent and the money/taxes pumped back into the economy maybe the stimulus to the economy at the time brought us all economic benefits, even if they weren’t ‘direct’ or observable?

However I find it hard to argue that a longer term approach like Norway adopted wouldn’t have been more prudent. If nothing else the visibility of the government having such an approach to saving must surely set a precedent for it’s citizens to follow. According to the World Bank, Norway’s gross savings rate (as a % of GDP) was a whopping 39% versus a carefree 11% in the UK.

ISA Millionaires

Since Lord Lee declared himself the UK’s first ISA millionaire the press & blogsphere has been rife with articles on how apparently easy it is to become an ISA millionaire. Lets assume you fill your ISA allowance every year from now and that the allowance increases in line with inflation every year at a rate of 2.5%. Lets also assume annual growth and returns of 5% each year. In 27 ears time you’ll be a millionaire.

If you can find the money to fill up your ISA allowance every year, then as seen by the example above, it’s perfectly possible you’ll become a millionaire in 27 years time. If your partner can fill their ISA allowances too then you can bring that down significantly. Not only would you be a millionaire but if your portfolio was yielding 5% per year you’d have a cool £50,000 1 tax free income a year to live off. Not bad at all.

The above route to millionairedom sounds like a no brainer, especially in these times of minimal interest rates. It’s why the likes of me are religiously stuffing their ISA allowances every year. It doesn’t involve winning the lottery, becoming a professional footballer or even appearing on a reality TV show. So why isn’t the middle class of this country2 full of ISA millionaires? Well the answer must surely be we’d rather spend the dosh we earn rather than invest it. Further more, the majority would rather do this and then borrow some more dosh and spend that too.

As a result rather than becoming rich from all of that compounding interest the opposite happens and all of the mortgage, loan and credit card interest eats away our future wealth. If you think longterm with your ISAs you can get rich.

Liquidity

When I bought my first shares I must have been around 18. To do so I had to buy them through my local bank branch and I received the physical certificates upon settlement. I can’t remember how much but I’m sure the commission was extortionate compared to the values of shares I bought.

Nowadays we can trade in and out of stock on our mobile phones in real time. Fees are constantly getting smaller and bid/offer spreads seem to always be reducing. Liquidity is on the up. In addition the advent of the internet means we have access to huge amounts of data at our finger tips.

10-20 years ago you’d have to obtain hard copies of annual reports from which we’d have to calculate our own ratios and metrics.

All of these factors are encouraging our holding times reduce more each year. According to this site, in 1940 the average holding period of stocks in the US was 7 years. By 1987 this had fallen to under 2 years and in 2007 (pre financial meltdown) it was only 7 months.

It is in the interest of brokers to make it easy for us to trade. The more we trade, the more we pay them and the less our returns are. It’s only relatively recently that we’ve started to see fund managers such as Terry Smith make a stand about fund fees and over trading and highlighting that this ‘liquidity’ has a big negative impact to long term returns.

Be In it To Win It

As a 20-21 year old I was buying and selling quite a few shares during the dot com boom. In the office I was working in at the time we’d have a weekly whip round and invest3 in some random tech stock we’d heard a tip on. For a good period most of the tips came off and I’d reinvest the winnings either down at the student union or into my personal account (and more tech stocks). Being a student on a placement job I was having a wail of a time and making some decent pocket money to boot.

When the crash came the value of my account went pretty much to zero. While I wasn’t too upset because my initial outlay was minimal and was more than offset by my realised profits, however the losses hurt me psychologically and I didn’t invest in any other shares for about 6 years.

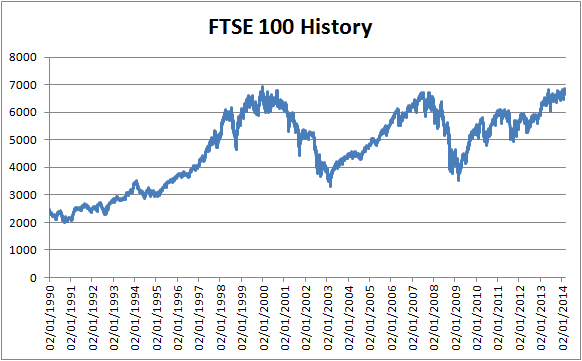

Looking back I missed a large chunk of one of the greatest rallies in the last 25 years. This example highlights the flaw in most retail investors. As soon as times get tough they panic and disappear form the market, not to be seen again for a very long time. If you can stay in the market and keep buying when others are fleeing you can pick up shares very cheaply.

Likewise in 2008 when the whole financial system was under threat there were some immense bargains to be had. In 2008 you could pick up the like of National Grid or Royal Dutch Shell on dividend yields of >7%. If you were thinking long term and were in the game you will have reaped the benefits.

Warren Buffett gave a perfect example of how he subscribes to the longtermist view in his most recent annual letter to shareholders of Berkshire Hathaway. Talkign of this firms investments in the ketchup fiirm H.J.Heinz Co and NV Energy he said:

“[these are companies that will] fit us well and will be prospering a century from now”

The fact that he even considers mentioning an investment time period of 100 years (even if he was just making a point about long term investing) shows you how important longtermism is in Buffett’s investing approach.

Growing a Money Tree is a long term past time. With all of this access to liquidity, information, access to trade ideas and strategies, fears of running huge losses in downturns I face a constant battle with my inner chimp not to over trade, change tack and abandon my longtermist approach.

Notes:

1 in today’s money

2 that can afford to fill their ISAs each year

3 read: take a punt

Great post – longtermism is a very difficult lesson to pick out of the investment scene because the story lacks drama. Trading is a much better story to sell, it’s dynamic, there’s a theme. Sadly for many of us it doesn’t really work.

I was also there in the dotcom bust, and they were fun times, I didn’t have enough invested to make a huge difference to my finances, and perhaps the training was worth every penny. It helped me get in there in 09 and buy NG 😉