The Office of National Statistics define household savings ratio as follows:

The household saving ratio is the amount of saving that households make in relation to available resources.

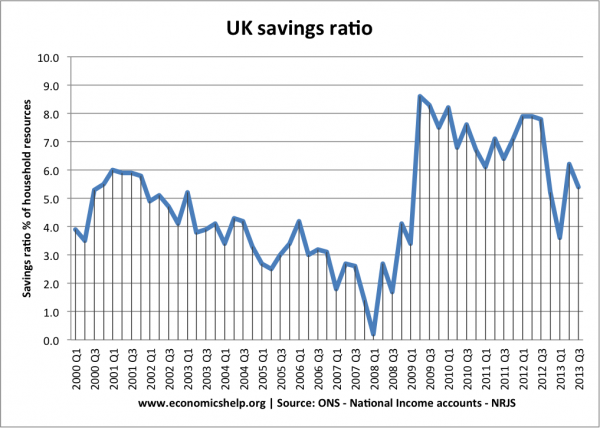

As you can see below in the early 2000’s the average savings ratio was falling and went as low as 0.2% in 2008. After sharply spiking as the financial crisis hit it is clear that savings ratios have been on the slide as the long wait for economic recovery has gone on. Currently as a nation we’re saving around 5.2% of our disposable incomes.

What is interesting in the graph above is how savings rates reacted to the financial crisis. As you can see prior to 2007 savings rates were gradually in decline as the nation binged on cheap and freely available credit.

Working in an investment bank I saw first hand the severity and speed with which the crisis happened. As the crisis unfolded employers very similar to mine going to the wall and several friends lost their jobs with little of no warning. As you can see the nations immediate reaction to the crisis and uncertainty it produced was to save more.

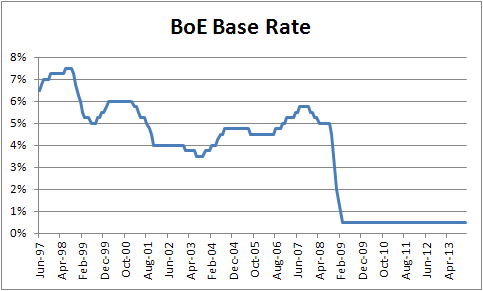

Thanks to the historically low interest rates in late 2008/ early 2009 our mortgage interest payments fell significantly thanks to the financial crisis. In fact the financial crisis proved a big wake up call for me financially.

Just as my employer did during the crisis, I immediately began to de-leverage my property portfolio by making over payments on the mortgage on our home. The logic was simple: if i lost my job I could take a mortgage holiday until I found another job.

As interest rates around the world plummeted our tracker mortgages got cheaper and cheaper. I’ve kept my repayments the same since 2008 meaning our disposable income has increased over time and so as a result has our savings rate.

Our Savings Ratio

Currently we save approximately 50% of out net household income. While this is not possible to maintain every month due to large exceptional items (mainly holidays to visit family living abroad), 50% is our aim.

I think it was my grandad that used to say ‘spend a third, save a third and invest a third’. Looking back that was pretty good advice however it did me no good. As a financially unaware 8 year old the entirety of my weekly pocket money was still deposited with the local sweet shop. It wasn’t until my late twenties that I began heed his advice.

How To Save

The hard part is saving the money in the first place. Now for the easy bit….what to do with those hard earned savings?

With interest rates at such a low levels the search for decent yield is harder than ever. As a result maximizing the benefits you receive from your savings is more important than ever.

That said for me it’s a pretty easy decision. There are 3 main destinations for our disposable income each month:

1 – Reduce Debt (33%)

Naturally it makes sense o reduce any outstanding debts before building up savings. Our only debts are our mortgages (3 buy to let and 1 residential). Overpaying our residential mortgage continues to be a priority. It seems rude not to do this while interest rates are so low.

That said, my most expensive loan on our home (we have two) is currently only charging 2.89%. As a result it could be argued that I’d be better off passing on the mortgage over payments and investing the money elsewhere. While the numbers support this advice, there is a strong psychological kick I get from overpaying the mortgage and seeing the term reduces over time and the amount I save on future interest charges increases.

2 – ISA Allowances (33%)

Investing in ISAs forms a key part of my investing strategy. The benefit of being able to access the future income they produce tax free is huge. By maxing out our households contributions for a sustained period I hope to build a portfolio that will produce a significant income. Getting this tax free will be a huge benefit.

Another key benefit of saving in ISAs is the ability to access your capital at anytime. Unlike pension contributions (see below) you’re free to access your ISA money whenever you need it.

3 – Additional Pension Contributions (33%)

Being a higher rate tax payer (for the time being anyway), it is well worth my while making additional pension contributions thanks to the 40% tax benefit.

There are many arguments about whether it is best to invest your spare cash in Isa’s or you pension. If you’d like to read all the pro’s and con’s be sure to read Monevator’s article on the subject here.

The proportions in which I allocate our savings cash to these three pots each month does vary over time but currently stands at around 33% in each. My main consideration is to keep the portfolio diversified (another argument to keep paying down the mortgage even if it’s not the most cost effective) and maximise our tax breaks.

I’d love to hear what your savings rate is and how/where you allocate the savings. Feel free to tell us by leaving a comment below.

Your granddad’s advice reminds me of the ancient wisdom in the Talmud (basically land / business / cash). Perhaps they didn’t need spending money in those days — there was always a lamb nearby to slaughter and eat…

I think a good tip with cash savings is to behave counter-cyclically. It was great saving cash in the years up to the crisis. Rates were high, and alternatives (shares and houses) looked expensive.

When cash became king after the blow-up, rates plunged — but there were other opportunities to bag bargains, whether in stocks, in cheaper buy-to-lets, or in haggling discounts at Harrods! 😉

Monevator – Great advice re cash. The temptation tp be fully invested in rising markets is a strong one. It’s painful to be reminded of it when you see clear bargains pass you buy when you don’t have the cash to invest.

There is some cognitive dissonance in this blog post

You claim “savings rates were gradually in decline as the nation binged on cheap and freely available credit” yet you seem to have two mortgages on your own home plus another three loans on some rented properties…

…then you say how cheap your loans are…

You seem to have done quite a bit of binging yourself, best way I can figure you probably owe £1m give or take

Your strategy seems to acting as a personal hedge fund specialising in UK residential property without the benefit of the veil of incorporation

This could either make you very rich or very poor – good luck

Keeping 1/2 of your savings easy to access in an ISA seems eminently sensible under the circumstances

Thanks for the comments Neverland. Maybe I wasn’t clear enough in this post. By binging I meant there were too many people out there borrowing money they couldn’t afford to repay and doing so without fully understanding the risks they were taking on. Similar to a drinking binge where you don’t consider the ill effects you’ll feel in the morning.

While you’re right in that I do have a substantial amount of [mortgage] debt (nowhere near £1m though 🙂 ), it was mainly all taken out before rates were cut to 0.5% and I have always been confident that our household could manage the repayments, even if rates spike up over 10% and we lost one of our salaries. It has all been a very thoroughly calculated risk.

I am surprised that the overall ratio is once again dropping. I do not think economies are so good for such complacency.

We are saving at around 24% rate. I wish I could do more, but I am unable to squeeze more out of our budget. But better than nothing.

People have too short memories in my opinion. I find it quite scary that the ration has dropped back again and no long term lessons appear to have been learned. 24% is not too bad at all!