After reading Monevator’s recent article about committing to a long term investment strategy it got me thinking about my own journey through investing my strategies past and present. In particular I’ve been devoting some time to think about where I sit on the passive v active investment see saw.

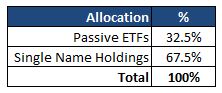

When looking at the equity investments in my portfolio the breakdown looks like this::

So on the face of it my portfolio doesn’t look very passive, and in a sense it isn’t. Only 32.5% of the portfolio is held in what most people would call truly passive investment funds. This part of the portfolio is held in a selection of very low cost index ETFs.

The remaining 67.5% of the portfolio is invested primarily in single name equities with a couple of small holdings in low cost investment trusts thrown in for some actively managed measure. Ignoring the ITs for now, I’m actively selecting stocks to invest in by reading annual reports, researching products, thinking about macro economic trends, looking at valuation metrics etc. Not very passive you might say.

In a sense you’d be right to call me a ‘know it all’ active investor, probably destined for failure, due for financial extinction headed towards a perfect storm of poor stock selection and over trading. However I believe strongly that my investment strategy IS a passive one in many respects.

There are two main reasons/excuses that I believe still mean I’m running a truly passive investing strategy:

1. Low Costs

One of the most compulsive arguments to choose a passive investment strategy is that the cost savings you make each year compound over time into a significant portion of future returns. The more you trade (or pay a fund manager to trade for you) the more your future returns will be diminished.

Well I’ve spoken before about how I like to squeeze the cheese. My portfolio is still very low cost, perhaps lower cost than a purely passive portfolio. All of the equities I hold have only cost me the initial trading fees + stamp duty. I don’t pay any ongoing brokerage account fees (apart from to reinvest dividends) and as a result that 67.5% of my portfolio has very low ongoing costs.

Since I rarely trade these equity positions, the equity portion of the portfolio costs less than the passive index ETFs I hold despite being twice the size. Mine is predominantly a buy and hold strategy so barring any major changes I should never need to sell these holdings.

2. Diversification

Diversification is often talked about in terms of reducing your exposure to loss producing holdings. I like to think of it and implement it in a slightly different way.

Within the FTSE 100 there are quite a few companies/sectors that I’m pretty bearish on. Retailers such as M&S seem to be having a perpetual fight to keep up with changing consumer trends and return to former glories, maybe Tesco is about to embark on a simlilar journey. Airlines (think Easyjet) are notoriously volatile, bouncing around in response to changes in oil prices as well as other economic factors. My long term approach doesn’t like these seasonal short term factors so I seek to dilute their effects on my portfolio.

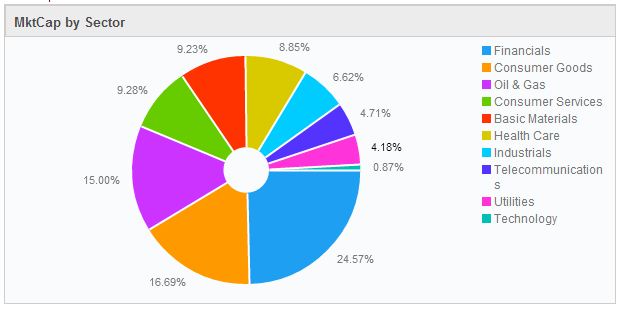

You can see below that the consumer services sector makes up 9.15% of the FTSE 100 by market cap. It’s not a sector I like particularly as factors such as seasonality, consumer tastes and disposable incomes tend to mean profits, prices and dividends of many of the firms in this sector are volatile.

I like companies such as Unilever or Reckitt Benckiser. They sell low ticket consumer good that we all buy and will continue to buy throughout future economic downturns. Companies like , Coca Cola and Diageo will still be turning good profits throughout the next recession and beyond. These companies tend to have sticky demand for their products which I like for the reliability of profits they generate.

By making equity investments directly in to companies in my preferred sectors like consumer goods companies (which makes up 16.69% of the FTSE 100) I can diversify my exposure away from the unwanted sectors within my index funds. I think of this as positive diversification.

Single Names Equities ARE Index Constituents

The reality is that most of the single name equity holdings I have are in big defensive blue chip companies (think Unilever, Cogate Palmolive, BP, Visa etc) and so are holdings that would be in the top 20 holdings of many common index trackers.

By selecting a subset of the FTSE100 to invest in, I have in effect created my very own UTMT40 index. This is an index of primarily defensive, stable income paying stocks that I hope to hold to perpetuity. I expect that 20 years from now they should all be throwing off increasing dividends and posting slow but steady capital growth to boot.

Is there any difference in me choosing the UTMT40 index rather than a simple FTSE100 tracker or Vanguards All World High Dividend UCITS ETF? Virtually every equity investment I make is done so with the intention of it being a passive (long term + low cost) investment while improving the ‘index’ of stocks I own according to my risk appetite. I’m still careful not to invest too much in too few sectors however I am simply free to avoid sectors I want to.

I’m not looking for a quick buck, a capital return or a sharp uptick in value. Instead I want slow, steady and more importantly reliable returns. I mentioned a while ago on the site that I’ve only made two sell transactions in the last 4 and a half years. I don’t expect to make any more in the next 5 years.

While many would call me an active investor due to my single stock preferences I consider myself very passive.

Hi UTMT

You’re right.

Holding direct equity does require somewhat more emotional stability though. That’s why I keep a portion of my hodings in an index fund.

If the market drops I can reassure myself that it are not only my direct holdings which are affected.

It’s also important (just like you stated) to hold quality assets. The economy doesn’t fail..individual businesses do.

Regards

FRD

FRD,

Emotional stability is one of the key ingredients for investment success.No matter what your strategy if you let it be influenced by emotion the you’re almost certain to fail to perform. When I look back at all of the poor investments I’ve made in the past they’re almost all driven by emotions (mainly greed).

Great to read about your strategy, thanks for posting. I’ve only just started investing in single name equities and am planning to hold them long term too. However, I can’t really see them making up more than 20% of my investment portfolio ultimately, although of course, that’s not to say my own strategy could change in the future. As for emotions, now that I know that emotion and investments don’t mix, I think I can keep them under control!

“Companies like Coca Cola … tend to have sticky demand for their products”: well said.

Hi UTMT

Great post, and something I completely subscribe to, although all my portfolio is in individual name companies (I do however have money in a defined cost company pension which is fund based). Like you I very rarely sell my holdings (should have sold Tesco a few months ago, but have held on on the “it can’t get any worse” presumption, how wrong was I.

However, generally been OK this year, and am currently level even with the Tesco handicap. I also invest in the larger companies with products that will be going strong for years, and, in my view will continue to pay out increasing dividends (over 5 year periods). Although I pay a small admin charge it is much less than I would be paying on unit/investment trusts, so over the years will be significantly lower than fund charges (costs are fixed so percentage falls as value grows).

Best Wishes

FI UK

Hi UTMT,

A very interesting post indeed. I invest predominantly in individual companies, but I do have small portions in ETF’s and bonds. I do actively buy sells, and more recently I have sold a stake in a company, so I could put the money in what I felt was a company that would perform better in the long run.

As strange as this might sound, I would still class myself as closer to a passive investor than an active one. I like to buy and hold for the long term. My counter to this is when a company I own is viewed as overpriced, and at the same time another company is undervalued, I will choose to sell the one for the other. This IS actively trading, but it’s not something I’m investing for (or hoping for). It’s just if an opportunity arises.

All the best

Huw

Huw,

I agree. Is someone that re-allocates between say a EM and DM index fund still passive? Is there a difference between this and re-allocating between single name investments? I’m not so sure there is much difference. WHat is important is whether you have ‘trading’ intent or a buy and hold philosophy.