Investing isn’t all about buying low and selling high. In the infinity complex world of finance there are many other factors apart from security prices that can have a material effect on the performance of your investments.

I’ve mentioned before that thinking about your personal finances as if you were managing a business is a great way to improve performance. If you drive down costs, improve the efficiency of your money as well as seek better investment returns you will eventually get rich.

How I Invest

I am by no means covering new ground when I say that the biggest drain on investment returns for most people will be the fees they pay others to move and/or invest their money. It’s been well documented here, here and here (amongst others) how fund fees can bleed your returns over the long term.

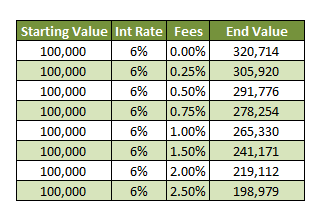

As the Escape Artist explains very well here, fund management fees can have a significant drain on your long term returns. In a similar vein as his example, the following table shows the impact fees can have on the end value of your portfolio. In this example I’m assuming you invest £100,000 for a 20 year period and achieve an annual return of 6%:

Look again at this table and consider that if you’re handing your pension pot or NISA over to a fund manager to invest you’re likely encountering fees of around 2.5% per year. In this scenario, using the above example you’ll end up with about £100k less than if you invested in a low cost tracker fund.

It’s for this reason that I generally only make two types of security investment (outside of my pension, more on that later):

1. Single Name Equities. I generally invest in income producing shares with a long term expected holding period (minimum of two years, preferably forever).

2. Physically replicated ETF funds. To aid diversification, track indices, invest in long term trends or markets easily, I invest in these low cost funds. If the expense ratio (TER) is >0.5% I won’t give them my money.

For both of the above types of investment dealing fees are kept minimal by avoiding over trading. I use an on-line broker for execution only services and I live and die by my investment decisions. It’s so much cheaper (and fun) when you do your own research.

If you’re investing in actively managed funds then you can almost certainly save yourself at least 1% in annual fees by switching to a low cost ETF or index tracker if you don’t want to actively manage your own portfolio.

Pensions – Squeeze the Fees

If you’re already investing in a pension then hopefully you’re already aware of the generous tax breaks on offer for making additional contributions (if not read this).

These tax breaks are a massive incentive to contribute more to your pension fund and will make a massive impact on the returns it gives you in the future. However look under the hood a bit further and there’s more you can do to squeeze some more cheese from your pension…

While I am not fortunate enough to be on a final salary pension scheme, I am relatively lucky in that my employer contributes the equivalent of 12.5% of my salary into my defined contribution pension scheme.

The fact that it is a defined contribution scheme means I should DO have to worry about where my money is invested so that I avoid bleeding my future returns into annual fees.

Unfortunately I’m currently unable to convert it into a SIPP, so I can’t have as much control over the investments I make (and fees I pay) as I’d like. Instead I am limited to the choosing between the managed funds and trackers allowable by my employers pension administration company. Typically a managed pension fund costs in the region of 2-2.5% per year.

If you’re reading this and have a managed pension fund the ‘fees’ alarm bell should be ringing by now.

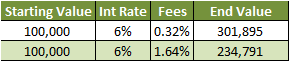

However, I’m one of the relatively lucky ones. A nice feature of the scheme I’m on is that my employer has negotiated a rebate on fund fees of 0.70% meaning that if I choose my funds wisely (i.e. Vanguard) I can keep the effective annual fund charges to be less than 0.5% (my current average across my selected funds is 0.32%). That’s not bad at all for a ‘managed’ pension fund.

What’s really interesting is that the ‘default’ funds I was invested in prior to changing them, meant that my effective annual fund charges were 1.64%, a full 1.32% more than I’m paying now. That’s great business for the pension company that selected the default fund but pretty crappy for most of my colleagues who I suspect have not changed from the default funds.

Using the example above (£100,000 invested for 20 years, returning 6% per year) I’ve effectively saved myself £67,104 in fees simply by switching my funds to ones with lower fee structures, assuming all other things like fund returns are equal….

…£67,104…..that’s a lot of cheese.

Great advice, albeit wasted on many people!

I had a similar situation with my work pension – for several years my employer refused to pay their contributions into my SIPP. This meant that the fees my pension suffered were higher than necessary (sadly Vanguard was not an option in that scheme). However, I got promoted and eventually discovered that everything was negotiable (seniority helps here). I eventually got to transfer my work pension to a SIPP, gaining control and cutting my expenses in half for the same investment exposure.

Escape Artist,

Great work getting your company pension scheme into a SIPP eventually.

It really does amaze me how much of an impact fees have. I find it quite sad that the average Joe’s retirement will be much leaner financially than necessary. All through a basic lack of financial awareness and the [quite frankly] unscrupulous profiteering from the pension industry/fund managers. What amazes me is that the these type of calculations (above) aren’t complicated at all, we’re talking GCSE level maths here and due to lack of awareness people are wasting thousands of pounds.