Last week Direct Line Group released it’s quarterly results. Compared to the first half of last year here are the main points highlighted on page one of the results statement, along with the reasons given by the board in ():

- Gross written premium fell 5.1% (“disciplined underwriting”…yeah right!)

- Operating profit fell 13.1 (claims from bad weather)

- Operating ratio of 96.6% versus 94.6% last year (claims from bad weather)

- Return on equity fell to 15.8% from 17.3% (no excuse given…probably the weather though 😉 )

- Interim dividend growth of 5.8% plus a special dividend of 10p per share (no excuse required on this one!)

Looking at the above ‘highlights’, apart from the dividend story, on the face of it there wasn’t a huge amount for shareholders to cheer after reading through the results.

Having been a shareholder since it floated in 2012 I thought I’d share my thoughts and conclusions having reviewed my position in DLG.

Capital Returns

It’s always reassuring to see the company’s dividend policy explicitly state that they “aim to increase the dividend annually in real terms to reflect the cash-flow generation and long-term earnings potential of the Company”.

Given that Direct Line’s states it’s plans to “generate long-term sustainable value for shareholders over the course of the insurance business cycle while balancing operational, regulatory, rating agency and policyholder requirements” they set the bar pretty high in their first full year as a public company as we’ll see below.

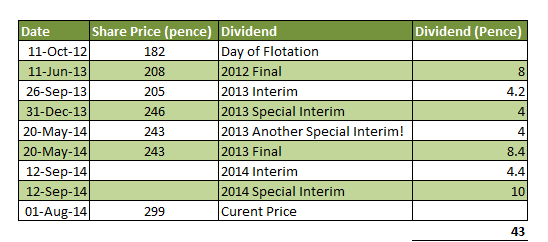

Since floating the company have managed to return significant sums of capital back to shareholders. As well as the expected regular and interim dividends in 2013 (8.4p and 4.2p) the group also paid two special dividends (4p and 4p) in 2013.

It would have been easy for the management to keep hold of some of the cash used for the special dividends for a rainy day which I think highlights the progressive dividend policy the company has in place.

Here is what the dividend history (and share price) has done since floatation:

That is some pretty impressive dividend payments. If you were lucky enough to but DLG.L when it was floated in 2012, including dividends you’d have achieved a total return of 80% in less than 24 month (before dividend reinvestment). Add in the interim & special dividend just announced and you’re up at 88%.

Perhaps more impressively is the fact that 24% of that return has come from dividends payments alone. Not bad at all for a boring old insurance company!

Direct Line’s Dividend Yield

Ignoring any special dividends that may (or may not) come in the future, DLG is currently yielding about 4.2%.

The scale of the special dividends DLG is throwing out is impressive. So far in 2014 the interim+special dividends of 14.4p have been paid without having any reduction of their solvency ratio (capital relative to premiums written).

Factor in some special dividends by using 2013’s total dividends of 20.6p and the current share price (£2.99) DLG has a backward 1 year dividend yield of 6.8%. When you also consider that we can expect the regular dividends to grow in real terms for the foreseeable, I would expect to see the total yield over the next 12 months or so to be about the 8-9% mark.

Is There More to Come?

One item that interested me in their recent results was this brief statement:

“Strategic review of International, with potential disposal being explored”

The Direct Line’s International business unit made an operating profit of £13.4m in the first half of 2014 and achieved a gross written premium of £328.8m in the last six months. I shan’t pretend I know how to value this business correctly however it’s safe to assume that if sold this would bring in a significant amount of cash to the group.

Any future sale of this International business unit is highly likely (in my opinion) to result in further special dividends being paid to shareholders. In a similar vein, the sale of the groups life assurance business to Chenara PLC in 2013 funded the lions share of the special dividends announced that year.

In total the 2013 dividends cost the company £242m. When you consider that profits after tax in the first half of 2014 were £175m, it has £846m of cash on the balance and debt levels are low at £75m future regular dividends look sustainable.

USPs

The company appears to be leading the way in rolling out telematics devices (black boxes for cars), particularly with young drivers. This is helping Direct Line to keep premiums down and payouts minimised. Any technology that lets it see how well it’s customers drive has to be a good thing for both parties involved.

All other things being equal this kind of technology won’t help it to improve margins but being first mover in this area of the market means it should win market share from rivals, or at least reduce any attrition of existing market share and provide a way to differentiate itself from many of the cheaper brands.

Share Price Performance

Given the amount of capital the company is distributing to shareholders it’s no surprise that the share price has been on an upwards tear since the flotation in 2012 and it’s spin off from RBS.

At the time of writing the share price has increased 65% since floating back in October 2012 to £2.99. Should the spare capital and special dividend payments dry up then I wouldn’t be surprised to see the short sharp drop in price.

It Can’t All Be Good

Cheap online discounters competing solely on price are of course a continued threat to the likes of Direct Line who doesn’t allow it’s services to be marketed by price comparison websites. This is particularly so at a time when household incomes continue to be squeezed. Direct line must compete using it’s brand and customer service.

While the gross written premium decrease of 5.1% was described by management as “reflecting disciplined underwriting in competitive markets” it is just another way of saying ‘losing business to lower cost competitors’. Longer term this is the biggest risk to DLG.

Top line revenue at Direct Line has declined year on year for the last 5 years from £5.7bn in 2009 to £3.9bn in 2013. The insurance industry is becoming ever more competitive with premium deflation industry wide becoming common.

These pressures on revenue mean that the group is ever more reliant on cost savings and increasing margins to offer shareholders value. The results also announced that DLG are back on track to achieve their targeted cost base savings of £1bn in 2014, after falling behind slightly in Q1.

Conclusion

While Direct Line continues to face squeezes to it’s revenues, margins and market share that may affect long term performance there are shorter term factors that continue to make this company attractive to shareholders.

DLG’s standard yield of 4.2 is squarely in the ‘target’yield range for the Money Tree, particularly with the boards stated aim to deliver future increases in the future.

Factor on top of that the prospect of more special dividends to come over at least the next 12 months, I’ll likely be holding my stake for a good while longer yet.