Under The Money Tree we don’t like debt so we have been diligently over paying the mortgage on the home we live in over the last 3.5 years. With interest rates so low, the tracker loans we’re on being cheap (see below) and having a reasonable amount of disposable income, we’ve seized the opportunity to make some serious dents in our mortgage debt.

Mortgage Over Payment Example:

Take a £100,000 mortgage charging 4% interest over a 25 year term.

Over pay by just £50 per month and you’ll save yourself £9,078 in total and be mortgage free 3 and a half years earlier than you otherwise would have been.

On our home we actually have two separate loans:

Loan 1. A variable rate tracker of 0.47% above the Bank of England base rate, so currently just 0.97%. This loan was ported across from our previous property when we bought our current house.

Loan 2. Another variable rate tracker charging 2.39% above base rates so currently 2.89%

image credit

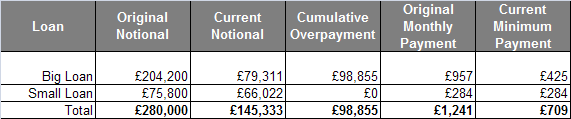

Before we get bogged down in the details, here are the key stats of where we started 3.5 years ago and where we are today after all of the over payments to date:

It makes no sense for us to overpay the first/small loan as it costs just 0.97% interest. I’d like to think that I could invest that money elsewhere and get a return of greater than that, even after paying any tax on the returns.

So, having decided to start this over payment journey, we’ve been attacking the big loan with over payments each month. Over the last 3.5 years our average monthly over payment has been £2,299. Factor in the fact that we maintained our monthly payments at the same level and each month that payment is reducing the outstanding capital even more.

So What Next?

Well as with all investments, it’s good to stop and re-appraise the situ every now and then. As I see it there are two main scenarios open to us:

Scenario 1 – We cease over paying today and just maintain our regular payments going forward

- Our big loan will have been paid off in 11.3 years since inception versus the original term of 25 years.

- We will have saved £58,416 in interest payments by our over payments so far

Scenario 2 – We keep overpaying at an average rate of £2,299 per month

- Our big loan will have been paid off 19.2 years early over just 5.8 years

- We will have saved £65,155 in interest payments

Well the prospect of getting rid of the big loan in a little under 3 years time is too appealing for me. Unless circumstances change we’ll be continuing to overpay.

But Why Bother?

Make Hay While the Sun Shines. Interest rates aren’t going to stay this low forever. When interest rates do go up, so will the cost of our mortgages. If I’m going to overpay I may as well do it now while rates are low.

Lower the LTV. By reducing your LTV (Loan to Value ratio) you can increase your chances of re-mortgaging onto an even cheaper deal. This is of particular interest to borrowers with high loan to value deals. It’s not much of a factor for us unless we decide to upgrade to a larger house at some point in the future.

Money to Invest. Psychologically the way I look at it is as soon as I shift the mortgage i’ll have more money to invest in the money tree portfolio.

Reduce The Outgoings. I like the security that if I got made redundant and suffered a massive loss of regular income I could revert back to the minimum payments on my mortgage. Thanks to the over payments I’ve already made, if i suddenly switched to the minimum payments and stopped overpaying I’d only have to find £709 each month.

If I really wanted I’m sure I would persuade my mortgage company to let me shift the loans to interest only deals for a period if money was short. Doing so would reduce the minimum payments further still down to just £245 per month.

The 7 Rules of Mortgage Over Payment Club

Over the course of my mortgage over payment journey I’ve discovered there to be 8 rules that are essential to follow if you want to get the most from it.

Rule #1: Overpay no matter what

When it comes to overpaying your mortgage, the key is to be consistent. The benefits of doing it are just like earning compounding interest on cash savings or reinvesting your share dividends, just in reverse. The more you overpay, the less capital you have outstanding. The less capital you have outstanding the less interest you get charged. They call it the snowball affect.

We’ve had months when cash flow dries up and money to overpay isn’t there. The day we buy our annual rail season tickets always makes me cry. Of course getting married a few years ago dented our finances substantially for a few months. No matter what, I’ve always been consistent and paid a token £50 extra rather than nothing. Consistency is key to keep the snowball rolling down the hill.

Rule #2: Keep Your Payments The Same Each Month

Mortgage companies are not stupid, they like charging you interest. From my experiences most mortgage providers will automatically reduce your future monthly payments if you make an over payment. They ‘assume’ you want your 25 year mortgage to remain a 25 year mortgage.

Unless you ask, each month you overpay they’ll probably just reduce what they charge you next month, keeping your term the same. In my case I had to tell my provider several times that I wanted to keep my payments the same.

If I’d let them do the above, the monthly payment on our big loan would have been reduced from the initial £957 gradually down to £425 (at the time of writing) in order for them to keep the term at 25 years. By keeping the payments the same each month I am now naturally overpaying by an additional £532 each month at no perceived extra cost to me. Every month I overpay this amount/benefit gets bigger.

Rule #3: Consider The Rates

Some might argue that I should cancel all of my over payments and invest everything in a nice dividend share like SSE.L that is currently yielding a whopping 6.31%. This is more than double the 2.89% interest I am paying on the big loan.

True but Under The Money Tree we like reducing our risk and working towards our long term goals (pay off mortgage debt, escape the rat race, build passive income). Instead we like to diversify the risk/reward and overpay the debt AND invest elsewhere at the same time. It’s not glamorous or exciting but it’s all part of the plan.

Obviously the higher the interest rate you’re paying the likely you are better off overpaying it rather than investing your money elsewhere.

Rule #4: Beware the Over Payment Penalties

Many mortgage deals here in the UK restrict the amount of capital you can overpay each year. Typically the restriction is 10% of the outstanding loan amount. Pay over this limit and you’ll face extra fees that will typically negate the benefit of any over payments made.

If you’re in a position to significantly overpay your mortgage be sure to check that you won’t come up against any such penalties.

Rule #5: Think About Inflation

The BBC recently reported that UK inflation is now running at 2.2%. In effect this should mean that my mortgage debt is being inflated away and that the true cost of that big loan isn’t 2.89% but just 0.69% (2.89% – 2.2%).

Traditionally high inflation is great for mortgage holders. As wages etc rise each year, the amount of capital you owe the mortgage company stays the same. Sounds great doesn’t it?

The only snag for me is that my wages aren’t inflating at all. Last year the big white envelope handed to me by the boss revealed no pay rise. I suspect it’ll be a similar story this year. If George Osborne won’t inflate my mortgage away for me I guess I’d better pay the bloody thing off myself.

Rule #6: Don’t Trust Your Mortgage Company

On a previous mortgage my wife adjusted her monthly payment upwards in order to make a regular over payment. One year later we were discussing how much was outstanding on the loan and the figure she gave me that came form the mortgage provider didn’t tie up with my xls approximation.

It turns out her mortgage company hadn’t applied these extra amounts each month to reduce the capital she owed. Allegedly their system only recognised over payments if they were made in separate payments from the regular direct debit. Because she had just upped the direct debit their computer didn’t recognise them as over payments.

I was highly skeptical of their ‘mistake’ and after much arguing and debate they relented and refunded the extra interest they had charged over the year as a result. This isn’t the only ‘miscalculation’ incident I’ve encountered with our mortgage providers.

In short, never trust your mortgage company to calculate the right amount. I keep track of all my mortgages in spreadsheets so I always have an approximate amount of what is outstanding.

Rule #7: Feel Smug

If you’re over paying make sure you pat yourself on the back. It doesn’t even occur to most people how much can be saved by repaying their mortgage early.

Leave a Reply to Under The Money Tree Cancel reply