I’m quite an impatient kind of guy. When I decide on something, I want it now. Since my decision a few years ago to seriously commit to achieving early retirement/financial independence I am often overcome with serious bouts of investment fatigue.

The main problem with getting rich slowly is that you’re not getting rich quickly.

In much the same way that I hit the mortgage overpayment wall, employing a slow and steady investment strategy often leads me to contract an impatient dose of frustration and apathy.

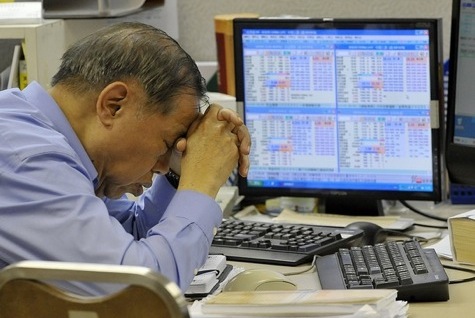

Investment fatigue is a dangerous condition. Based on my own past experiences it can and often will lead to the following symptoms:

- Over trading – Getting frustrated with the speed of wealth creation can lead to you doing stupid things. If one of your blue chip powerhouses releases a set of poor results or cuts their dividend you might be tempted to panic and sell or switch to another. If you’re not careful constant tinkering can drain your returns.

- Under trading – While I am an advocate of long term investing, ‘buy and forget’ can sometimes be taken too literally. When you’re waiting to get rich it can be too tempting to simply forget all about it and just focus on living life rather than worrying about eps, p/e and div yields. Leaving a poor investment to die a slow death is something all investors should avoid.

- Excessive risk taking -When fatigue reigns you might be tempted to take a short cut and invest into that red hot Nigerian oil company your mate mentioned down the pub. Or you might take a punt on some leveraged product you don’t really understand in search of a multi bagging success. Doing so usually ends up in tears.

photo credit: Mike Clarke AFP/Getty

I suspect the most common cause of investment fatigue is poor performance. Retail investors are renowned for cutting their losses and selling when the markets are down, which is usually the time to be buying. Us humans are sensitive creatures and it can be much easier to walk away from a bad investment and never return rather than learning from the experience and coming back with a new plan.

As mentioned above, for me the biggest cause of investment fatigue is the pace of progress. I’m 36 but already I’m ready to retire. While I know I’m making good progress in my personal journey to financial independence and with fair winds can probably get there in the next few years, I want it now.

How to Deal with Investment Fatigue

1. Don’t Forget Your Goals.

One useful way to ensure you stay motivated with your investments is to set yourself goals, in particular SMART goals. While this is sort of thing is a little bit too David Brent for me it is good advice. When setting a goal try to make sure all of your financial goals are:

Specific Measurable Actionable Realistic & Timely

Lets look at an example. I currently have a set of goals written down related to my NISAs:

Short Term (Monthly) – e.g. save £500 into my NISA account each month

Medium Term (Annual) – e.g. use my full £15,000 NISA allowance this year

Long Term – e.g. Build NISA portfolio to a value of £200,000 by 2019

All of these goals match these SMART criteria. They’re all very specific, are time bound and are written in such a way that I can measure my progress against them easily. It will be very clear to me if I’ve achieved them or not. They’re also realistic in that they are possible to achieve while at the same time they will require a large amount of effort and discipline to achieve.

2. Review your progress

If you’ve set yourself goals be sure to review your progress against them regularly. Doing so will usually make you more accountable to yourself as we all have an inbuilt fear of failure.

When you’ve been a good girl/boy and you’re hitting your targets then give yourself a nice pat on the back. On the other hand if you’re currently under performing, use it as motivation to make the necessary changes to get yourself back on track.

Sometimes when progress seems slow, it’s useful to take stock and see exactly where you are and where you’ve come from. I use a simple spread sheet to track my net worth and monthly income generation. By updating it and looking to see what shape my finances are currently in usually gives me the motivation to continue.

Take the time to think back to your financial situation when you first started your investment career. It’s probably that you’ve learnt a lot and come a long way. Even if you’re just starting out the fact that you’re reading this likely means you’re already learning and have changed your mindset to finances.

3. Plan Your Activities

A lack of direction or purpose often leads to boredom and apathy. I always try to start every week with a list of specific activities I want to achieve that week. There’s always a never ending list of jobs to do so I try and focus on those that will provide some long term financial benefits. Leafing through the notepad that I always carry here are a few examples from the last week:

- Open an additional Santander 123 account in my wife’s name

- Re-new car insurance (and not get ripped off by the extortionate renewal quote)

- Ebay more of the accumulated ‘stuff’ in the garage

- Claim work expenses (long overdue)

- Read Unilever’s half yearly results update

- Read Glaxo’s latest quarterly results update

- Finish building pallet wood store (to house/dry the free firewood I acquired in the winter)

- Update buy to let accounts xls

By having the above list with me during the week I’ll spend less time staring at the daily price movements of my portfolio and more time taking action on things that will help me grow the money tree.

4. Take some exercise

I am a strong advocate that exercise can help solve most problems. By exercising regularly I reduce tiredness, relieve stress, increase my productivity, boost creativity and give myself a strong sense of well being.

I’m not a weights guy, a protein shake guzzler or a gym bunny. Instead I keep my exercise relatively low tech (like Rocky) and cheap. Going for a hard run or cycle is not only cost effective exercise, but it is my way of downloading the nonsense that builds up in my brain and resets my mood to a state of calm, focussed readiness.

5. Mo’ Money!

The only way to get richer more quickly (without taking more risk) is to make invest more money. If your chosen investment strategy is taking too long for you then turbo charge it by making some more money to invest.

‘How?’ I hear you say. Well that’s the million dollar question and one I can’t answer for you. The truth is that if you put your mind to it you can make some more $. Whether your selling some junk on ebay or founding a tech start-up most of us could start making a few extra pounds to invest if we really tried/wanted.

Don’t let it get you down people…..keep investing!

Leave a Reply to Under The Money Tree Cancel reply