I’ve been debating over the last few weeks about how much contribution to make to my personal pension. As with most of the unlucky under 40’s in this country, I’m on a defined contribution pension scheme. Up until now i’ve not made any contributions of my own, instead i’ve been focusing on diverting my cash into building future income streams that I can draw on before I reach retirement age. To date all spare income has been invested in my property portfolio and stocks and shares ISAs. The plan has alway been to retire early and up until now my pension has had to be on hold to try and make this happen.

Recently I’ve been thinking more and more about the tax benefits to be gained from making additional pension contributions and doing a few sums. Whilst reading through the HMRC website I stumbled across this nasty little paragraph:

If your ‘adjusted net income’ – read more below – is over £100,000, your Personal Allowance is reduced by half of the amount – £1 for every £2 – you have over that limit. If your income is large enough, your Personal Allowance will be reduced to nil.

So for every £2 you earn over £100,000 your personal tax allowance is reduced by £1. In effect this means that if you earn over £100,000 per year, any income between £100,000 and £120,000 is effectively taxed at a rate of 60%.

While I realise I’m in a fortunate position to worry about such things, this is exactly the kind of inconsistency that makes a lot of people hate our income tax system. Personally I believe either a pure flat rate tax rate or a much more gradual tax scale would be much more transparent, fairer and easier for all to understand for all.

Play The Game

Without a simple tax regime in place in this country, the likes of me (and probably you) are incentivised to find ways to optimise our tax affairs in order to pay as little tax as the regulations allow, in order to get the most from the hard earned dosh we get paid.

There’s often a fine moral and legal lines between tax avoidance (the legal tax game) and tax evasion (go to jail stuff). What is unfair is that it is usually those on lower incomes that don’t have the means, inclination or education to pay the tax game.

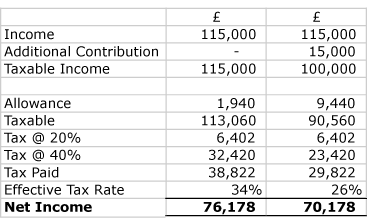

Lets look at the example below…

Assuming you get paid £115,000 your tax free allowance gets reduced down from £9,440 to 1,940 by the fact that you earned £15,000 over the £100,000 threshold. Overall you’re effective tax rate is 34%. However if you make an additional pension contribution (as shown in the third column) of £15,000 two things happen.

- You gain back your full tax free allowance of £9,440 because your taxable salary is £100,000.

- You will receive a 20% tax benefit that your pension company claims back from the government. This means they’ll add on another 20% to the £15,000 meaning your pension actually benefits by £18,000 not just the £15,000 you put in.

Of course don’t forget that if you make a pension contribution out of your net salary and are a higher rate tax payer you’ll need to claim back the extra 20% via your self assessment form.

Does your company do matching contributions, too? As you’re in finance and have a pretty snazzy income (congrats! 🙂 ) I’d bet they do.

The maths can be incredibly compelling in that case, once you compound the tax saving and the ‘free’ money from matching contributions.

No matching contributions. They just pay in a % of my salary each month. Any additional contributions I make are purely up to me and the taxman. The % they pay in rises (slowly) over time.

The annual allowance is another complication. I am in a public sector pension scheme but would also like to pay into a SIPP to negate the loss of personal allowance between 100 – 120 thousand. Annual allowance is likely to be a factor at some point in the near future.

The only option after that is to invest in VCT, EIS, or increase charitable donations. Obviously you don’t get the 60% tax relief that a pension investment would give.

Firstly, I like your site. I have a similar principle regarding my approach to wealth creation but I’ll save that story for another time and perhaps a mini-blog one day…

On the above, there seems to be a crucial end step which you’re left out of the maths to drive home how important this element of tax system is for people who annually earn around the 100k threshold to understand. Its not just a question of reducing your effective tax rate.

For me, you need one more line on the table to assess the Do-Nothing Vs Do from a perspective of total net worth increase for that year, which include the usual pension sweeteners. Its a multiple layered set of tax benefit.

I guess the point I’m making is that its even more important people work out the maths behind this quiet tax increase on the “wealthy”; the post underplays this a little.

Thanks for the comment. I fully agree that a second slice of benefits come by the extra tax relief applied to your pension contributions. The last sentence could have emphasised this more clearly.

Does your employer offer salary sacrifice in exchange for direct payment into your SIPP? This would save you 2% NI and would save them 13.8% NI, some of which they may pass onto you. On the other hand it may affect your bonus, lol!

Unfortunately they don’t offer salary sacrifice 🙁

The only reason I would think twice about not maximising pension contributions is that the age at which you can take it is increasing from 55 to 57 in 2028 so if you are 41 now (or is it 43) you will have to wait longer which much reduces the attractiveness of pensions. There is talk of increasing the age at which you can access the money in future years. Scary…

That being said for a 40 / 45% tax payer with a good ‘outside of pensions’ plan already with a very high salary in your 30’s you should think about maxing out your pensions. Just view it as tax deferral reduced by generous tax relief now.

My strategy was to max out pensions (currently 1100K @ age 45) but neglected ISA’s for many years and ignored BTL, but I am working on a backup plan to give me income in a couple of years – kind of reverse to you. (you are well sorted outside of pensions and now considering them)