Dividend investing forms an integral part of my plan to grow my money tree. According to the investment bank Morgan Stanley 42% of stock market returns since 1930 have come from dividends. For the long term investor then, it is crucial to consider how dividends affect the value of your portfolio over time and to utilise them to maximise your gains.

In this article I’ll share the dividend investing rules that I do my best to abide by. However I’m ashamed to say for some of the rules it’s a case of do as I say not as I do!

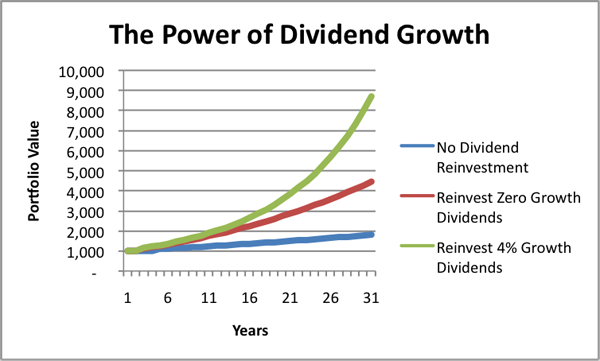

First let’s plot a quick example that we’ll refer to later in this article. In this example lets assume the following:

- An initial investment of £1,000 in a dividend paying stock

- The share price increases by 2% per year

- The starting dividend yield in year one is 4%

- Annual dividend growth of 4% (for green line)

Here’s what the chart looks like….

Rule #1: Always Reinvest Dividends

The first rule of dividend investing is you always reinvest your dividends. It is the most fundamental principle behind the benefits of dividend investing. It enables you to benefit from what is often termed the snowball effect of compounding interest.

By reinvesting your dividend payments into additional shares you’ll benefit the next year by also earning dividends on these reinvested shares. So long as you keep reinvesting the dividends every year you’ll be able to buy more and more additional shares as the dividend payments you receive will keep increasing. It becomes like a snowball rolling down a hill…the further it goes the bigger it gets.

To see the big impact that reinvesting dividends has, compare the blue line above (no dividend reinvestment) to the red line (reinvesting a non growing dividend). After 30 years your £1,000 investment is worth £4,454 (a 445% return) compared to just £1,811 (181% return) if you had spent your yearly dividend cheque on sex, drugs and rock n roll each year. You might not have as much fun but by reinvesting your dividends you’ll be richer!

Welcome to the world of dividend investing! But what is the green line i hear you say?! Well I refer you to rule#2 for that one!

Rule #2: Always Seek Dividend Growth

We’ve seen in rule#1, by reinvesting your dividends each year you are effectively increasing the amount of future dividends (or income) you’ll receive the following year. The next rule I try and abide by is to invest in companies that will consistently grow their dividends year on year.

In the example above look at what happens (the red line) when the annual dividend is increased at a rate of 4% per year. After the 30 years your portfolio would be worth a whopping £8,705 compared to the £4,454 if you’d reinvested a non growing dividend. Just look at how that red line shoots upwards over time.

Of course finding companies who will be able to grow their dividends year after year is not necessarily an easy task. However by abiding by some of the other dividend rules below (particularly rule#8) you’ll hopefully improve your chances.

Rule #4: Don’t Chase the Yield

As a general principle the dividend yield of a share can be thought of as a type of risk measure. Why bother buying a share like Unilever (UNI.l) that only yields 3.5% when another FTSE 100 company Fresnillo (FRES.l) currently yields 8.6%? Well to put it bluntly, the market thinks Fresnillo is facing problems and both your capital and the chances of receiving future dividends are at risk.

The more risk there is that the company will not be able to keep paying or growing it’s dividend the higher the yield tends to be. Your job as an investor is to decide your risk/reward profile and invest accordingly.

It’s always worth reminding yourself that the dividend yield figure you often see quoted in the newspaper or on websites is a backward looking measure. It usually compares last years dividend per share to last years earnings and in no way guarantees the yield the share will produce at any point in the future.

Rule #5: Don’t Forget Dividend Cover

Another key metric to look at is dividend cover or the payout ratio. This is simply calculated as:

Dividend per Share

Payout Ratio = divided by

Earnings Per Share

This ratio tells you how much of the companies earnings are being distributed to shareholders. Ideally I like this ratio to remain less than 50%. The higher the ratio the more chance there is your future dividends may be cut if the company experiences a future drop in earnings or increase in costs.

Rule #6: Play The Long Game

Dividend investing is a long term game. As we’ve seen above the longer you stay invested the better the gains you’ll receive and the bigger your portfolio will grow.

If you want to grow your money tree too, the most important rule is to be patient. When you start an income portfolio it can be a little disheartening when at the end of year 1 you receive your dividend cheque.

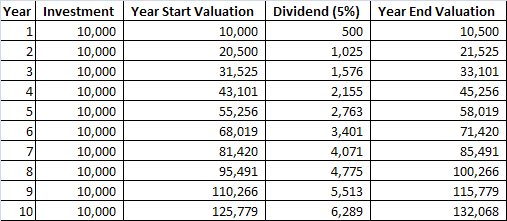

Lets look at an example where you invest £10,000 into an ISA (or any other tax free vehicle) every year and manage to get a steady dividend yield of 5% each year.

As you can see after year 1 you receive £500 in income which lets face it, isn’t going to enable you to retire any time soon. However assuming you keep investing your £10,000 each year and reinvesting those 5% dividends, after 10 years your portfolio will be producing £6,289 in income each year.

To look at it another way in the graph above look at how the steepness of how the red and green lines above increases over time. This effect is what makes dividend investing powerful. The longer you stay invested, the more income your investment will generate.

Rule #7: Focus on Current Yield Not Cost

Don’t get too hung up of the historical or cost yield of a share. While it’s nice to look back and see an investment performed well you should instead focus on the opportunity cost of other investments.

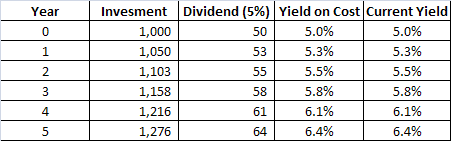

Let’s look at an example. Lets say we invest £1,000 for 5 years in a share that yields a constant (non growing) 5%. Lets also assume the share price remains constant.

As you can see your yield on cost after 5 years would have risen from 5% to 6.4%. While this increase in the yield on cost will likely give you a warm smug feeling inside you shouldn’t feel too complacent.

Your investment is now worth £1,276 not £1,000 so your real or current yield is actually still only 5%. The yield on cost is a backward looking measure and not really relevant to your current investment decisions. If you find an alternative share with the same prospects, earnings power and risk profile that is yielding slightly more at say 5.5% you’d be a fool not to switch your holding.

Rule #8: Check Your Priority

Always keep an eagle eye what the company says in relation to dividends and shareholders. For example on SSE PLCs investor relations website it says the following:

SSE’s strategy is to deliver sustained real growth in the dividend payable to shareholders.

When I read something like the above it gives me confidence that this is the board’s main priority it to continue t grow dividends over inflation. By failing to do this will have a direct impact on the companies share price so after declaring such a clear strategy they will think twice before failing to deliver dividend growth in real terms.

Another thing to look out for is very subtle changes in the language used when companies state or discuss such strategies. In the above example if SSE were to suddenly drop the ‘real’ from the above statement I would start to get worried that the next dividend would increase by less than the current rate of inflation.

Rule #9: Diversify, diversify, diversify

Even with some of the safest, defensive blue chip income stocks future dividend payments are not safe as shareholders of BP in the summer of 2010 can testify. In an instant a steady yielder can be forced to withdraw it’s dividend completely.

What the dividend investor needs to be wary of is that there is usually a double whammy waiting to punish them. As soon as the company announces it is stopping or reducing it’s dividend payments the share price is almost certain to fall as well as the stock becomes immediately less attractive for investors to hold. In the case of BP after the deep water horizon oil spill in 2010 the share price fell by over 50%.

It’s not always possible for even the most diligent investor to foresee events that will cause a reduction in dividends. The only way we investors can reduce the risk is by means of diversification. As a general rule I aim not to have more than 7.5% of my portfolio invested in any one security. Of course I also try to not have to much concentration in any one sector or country (i’m still working on this one!).

Nice points. I like the yield advice vs. cost. I do the same and look at the yield. If the yield is at or above my 3.5% threshold I am buying no matter what the price is.

Great blog!

Just a couple of points

#1 perhaps should be qualified – unless you need the dividends for immediate income…

#5 Also, don’t forget free cashflow cover – possibly more crucial than dividend cover as earnings can be massaged.

Cheers

This year I got dividend of 50 against 50,000/- (5000 unites x 100 per unit) invested on july-2013 end of Oct-2013 was nil-dividend, end of 31 Dec-2013 – I got 50-dividend for 50,000/-

Please guide me how to calculate my benefit

Hi Asad,

Apologies it is not immediately clear to me exactly which stock you are talking about. Could you provide me with the ticker?